How to find undervalued stocks? Here are 3 useful tools to help start your search

Content

Either way, underlying fundamentals typically suggest undervalued stocks aren’t priced accurately. When all is said and done, an undervalued stock is simply an equity with room to grow. Sometimes, stocks are undervalued because they’re pulled down by their sector or the overall market, says Daniel Milan, managing partner of Cornerstone Financial Services in Southfield, Michigan. However, the companies of such undervalued stocks usually have strong balance sheets, good net free cash flow and a strong future outlook.

- However, during this period, several growth and penny stocks have delivered multibagger returns.

- But there are pockets of opportunity, notes Morningstar sector director Brian Bernard.

- If the numbers diverge significantly, it’s worth taking a closer look at the company’s earnings estimates or news coverage of its business to better understand the disconnect.

- As technology makes more inroads into modern vehicles, Qualcomm sees its auto segment doubling several times over the next few years.

An undervalued stock is one that is consistently profitable and has the potential for long-term growth but whose share price is cheap compared to its peers or companies with similar prospects. While that might seem impressive, the share price recovery is still in the early innings. The company’s stock, while up this year, is currently trading 53% lower than where it was five years ago. That shows just how devastating the Covid-19 pandemic was on cruise line operators such as Norwegian. Looking forward, Norwegian Cruise Line said it expects a full-year 2023 profit of 75 cents a share, up from a previous forecast of 70 cents per share.

Alphabet Inc. (NASDAQ: GOOGL)

The selloff appears overdone, and may even represent a great opportunity to start a position in a strong company for much less than it was trading for 12 months ago. On top of the recent drop, Autodesk looks relatively cheap compared to its peers in the software industry. Before we get to the best undervalued stocks to buy now, however, let’s first look at what an undervalued stock is. Bancorp, another stock Morningstar says is cheap, is down nearly 20% this year. That means its also nearly 40% off its intrinsic value of 58 a share. Morningstar thinks the Minneapolis-based bank is going to be a survivor.

That is more than enough capital to survive and even flourish in the currently overcast economic climate, which is unusual for a tech company. At MoneyWorks4me Portfolio Advisory, we specialize in helping investors navigate market fluctuations and build a strong, diversified portfolio. With our collaborative approach, you can maintain control over your investments while benefiting from our expertise and guidance. It’s been a little over a year since Microsoft announced their plans to acquire Activision Blizzard in an all-cash deal that would value the company at $68.7 billion, or $95 per share.

Disadvantages of Undervalued Shares

The increase is expected to originate $48 billion in consumer auto loans. For starters, Ally is trading at a relative discount compared to this time one year ago. Over the course of 12 months, shares have done nothing but decline based on the fears most undervalued stocks of a looming recession and headwinds in the automotive industry (Ally’s primary lending specialty). As a result, shares of Ally are trading at about half the price they were at the beginning of this year and hovering just above 52-week lows.

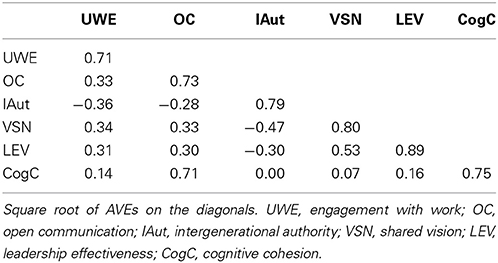

Otherwise known as the price/earnings-to-growth ratio, the PEG ratio gives insight into the relationship between the price of shares, the earnings generated per share, and the company’s expected growth. Autodesk has a PEG ratio of 3.34x, which makes it one of the most undervalued stocks in today’s tech sector. One way to find undervalued stocks is by looking at a stock’s price-to-earnings ratio, also known as PE ratio. The PE ratio is calculated by dividing the company’s stock price by its earnings per share. To find the earnings per share of a company, divide its earnings from the past 12 months by the number of shares issued and held by stockholders. If you find a company’s stock has a lower PE ratio, there’s a chance you could be getting valuable stock at a discounted price.

Opportunities do exist, though, particularly in biopharma, healthcare providers, and diagnostics and research, reports Morningstar sector director Damien Conover. One of the benefits of using the RSI is that it can help traders filter out noise in the market as it is less susceptible to false signals than other indicators, such as moving averages. Additionally, the RSI can be used in conjunction with other indicators and analysis methods, such as trend lines and candlestick patterns, to improve accuracy and capture more profitable trades. Note that trading on leverage magnifies your risk, because your profits and losses are both calculated on the full value of your position – not the deposit used to open it. Always take appropriate steps to manage your risk before committing your capital. At the same time, the company has reduced debt on a quarter-on-quarter basis.

What are the Most Undervalued Stocks Today?

In fact, if 5G turns out to be the “game-changer” many are expecting, this could be just the beginning of a historic run. But if you’re looking for discounted stocks with lasting power, Morningstar says this market is giving you plenty of opportunities. With GOOGL stock currently trading right around $120 a share, it presents a nice entry point for investors. If you’re looking for undervalued stocks, there are strategies you can use. A general principle is to ensure individual stocks don’t make up more than 10% of your portfolio.

The global economy is still finding its footing amid ongoing pandemic-related challenges. But consumer travel is enjoying a resurgence in interest as younger generations rank experiences as more important to them than purchasing physical things. Additionally, travel is still depressed in some international markets. Booking — the parent organization of Booking.com, Priceline, Agoda, and KAYAK — may not be the high-growth company it was in the 2000s and 2010s. Nevertheless, it still has plenty of gradual growth ahead of it thanks to these new travel trends.

And in Q2 2022, Alphabet missed analysts’ revenue expectations of $69.9 billion due to slowed growth, reporting $69.69 billion instead. COVID-19 vaccine revenue is set to continue boosting the company’s cash flows in the coming quarters. Nevertheless, Pfizer is stepping up its acquisition to increase visibility and expand its product line in preparation for the COVID-19 vaccine demand decline. In fiscal 2021, Pfizer reported an impressive revenue of $81.3 billion, an increase of 95% or $39.6 billion compared to 2020. The revenue reflects an operational growth of 92%, thanks to Comirnaty, its COVID-19 vaccine that generated over $37 billion.

While it may not look like much on the surface, dividends are great hedges against inflation. Starting a position in Lowe’s today could help investors build a new income stream to stave off economic instability. Subsequently, the dividend should help hold over investors until the stock makes a comeback. Two different investors with unique strategies can look at a single equity and come to two different conclusions based on its valuation. On the one hand, an undervalued stock may be an equity that has been sold off due to an overreaction from an earnings report. On the other hand, an undervalued stock could just as easily be an equity with plenty of unrealized potential.

The most ‘undervalued’ stocks in Finland

For more about how we calculate our fair value estimates, think about the Morningstar Uncertainty Rating, and more, read Morningstar’s Guide to Stock Investing. Basic-materials stocks have underperformed the broader market this year and are coming into the third quarter about 10% undervalued. Morningstar strategist Seth Goldstein reports that 70% of the stocks that Morningstar covers in the sector are trading with Morningstar Ratings of 4 or 5 stars. While building-materials stocks remain overvalued, many stocks in the agriculture and forest products industries are underpriced, as are three fourths of the chemicals stocks under our coverage.

- Despite increasing sales and earnings, investors continued their exodus out of Zoom’s stock due to concerns over declining pandemic tailwinds.

- Its trailing twelve-month P/E ratio of 12.1x is significantly down to its 5-year median P/E ratio of 22.6x, as well as that of many of its biggest competitors.

- JPMorgan has plenty of other levers that it can pull to drive growth.

- That shows just how devastating the Covid-19 pandemic was on cruise line operators such as Norwegian.

From a financial perspective, the company reported cash and equivalents of $409.2 million as of March. This provides ample flexibility to invest in completion of the Rochester Hub. Nordic American is well positioned on that front with net debt at $168 million. With strong day rates, debt servicing is not a concern and Nordic American can continue to pay robust dividends. With interest rates eclipsing seven percent and inventory levels remaining low, few people are inclined to buy or sell. The lack of activity suggests more people will stay in their current homes.

You’re our first priority.Every time.

However, it is important for investors to consider why the company is under or overvalued in the first place. PEG ratio looks at the P/E ratio compared to the percentage growth in annual EPS. If a company has solid earnings and a low PEG ratio, it could mean that its stock is undervalued. To calculate the PEG ratio, divide the P/E ratio by the percentage growth in annual EPS. You can find the best undervalued stocks by looking at the list provided by Benzinga in the article above. Undervalued stocks offer minimum risk and guarantee higher ROI, unlike overvalued stocks.

Subsequently, Pfizer’s status as a global pharmaceutical behemoth has been strengthened and reinforced. Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). These offers do not represent all available deposit, investment, loan or credit products.

The U.S. stock market finished the second quarter up more than 8%, as measured by the Morningstar US Market Index. In the past couple of years, much of the company’s resources were focused on solutions to stem the global spread of COVID-19 and save lives. For instance, in 2020, Pfizer’s partnership with BioNTech led to the successful development of the first COVID-19 vaccine that saved millions of lives worldwide. The company also scored another win in its fight against the pandemic when in December 2021, the FDA approved Paxlovid as the first oral pill for coronavirus.