QuickBooks: A Beginners Guide to Bookkeeping and Accounting for Small Businesses by Michael Kane Ebook

Content

That means you can start out with basic bookkeeping at a modest cost and ladder up to more advanced services as your business grows. Revenue is all the income a business receives in selling its products or services. Costs, https://www.bookstime.com/articles/enrolled-agent-exam also known as the cost of goods sold, is all the money a business spends to buy or manufacture the goods or services it sells to its customers. The Purchases account on the chart of accounts tracks goods purchased.

How do I set up manual bookkeeping for my small business?

- Choose Cash or Accrual Accounting.

- Set Up a Business Bank Account.

- Pick a Bookkeeping Software Package for Small Businesses.

- Create a Chart of Accounts.

- Set Up an Expense Tracking System.

- Prepare Your Bank Reconciliation Process.

- Set Up Your Financial Reporting System.

- Getting bookkeeping help.

Small businesses also handle aspects of accounts receivable, which ensures your business is paid for its goods or services. This can include estimating the eventual value of a finished project, preparing and sending invoices and providing statements. Accrual-based accounting records those invoices and bills even if the funds haven’t been exchanged. Generally, accrual-based is the recommended accounting method, but the decision is ultimately up to you.

Best for Service-Based Businesses

If you handle a low volume of business transactions, single-entry is probably enough. Double-entry bookkeeping requires at least two entries per transaction — a debit from one account and a credit to another. IN 1494, LUCA PACIOLI invented a double-entry bookkeeping concept, which became known throughout the world. Pacioli was not the first to have bookkeeping and accounting practices. However, he was the first to describe the debits and credits concept.

- As a sole proprietor, freelancer, or small business owner, you can choose between using a traditional hand-written ledger, spreadsheet software, or accounting software.

- For US store owners, the IRS doesn’t require you to keep receipts for expenses under $75, but it’s a good habit, nonetheless.

- Revenue could be made through product sales or payments for services rendered.

- An accounts payable account gives you a clear and simplified view of when your payments are due and helps you avoid duplicate payments.

- Generally speaking, accrual accounting is better for larger, more established businesses.

As your company grows, you’ll probably want to move towards accrual accounting, but it’s not a necessity when starting a business. To understand better who has paid and who still needs to pay, business owners must incorporate a system for accounts receivable, or how the company gets paid for delivering goods and services. This includes generating and sending invoices and tracking payments. Under single-entry, journal entries are recorded once, as either an expense or income. Assets and liabilities (like inventory, equipment and loans) are tracked separately. If you’re just starting out, are doing your books on your own and are still in the hobby stage, single-entry is probably right for you.

Choose your bookkeeping method

For a business to succeed bookkeeping and accounting must be done. How you set this up will determine the amount paid out for services, versus what you keep in-house. The size of your company also weighs in on the choice you make to have an accountant prepare documents or whether you prepare everything yourself. QuickBooks is part of Intuit’s software line, founded in 1983 by Scott Cook and Tom Proulx. While some functions are similar to QuickBooks, it is also meant for larger businesses.

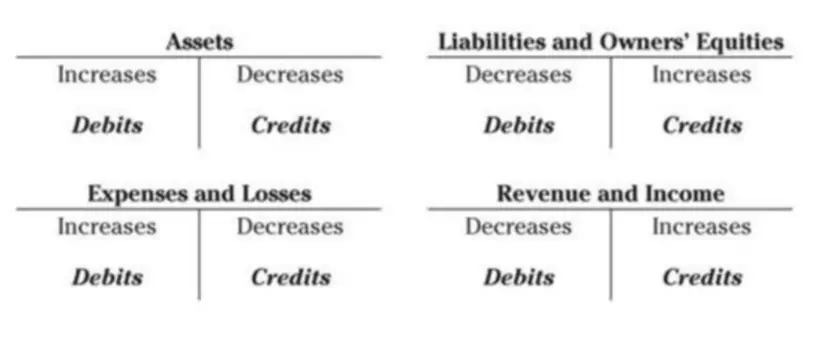

It’s no surprise why business owners love this one, as the sales account is where you record all incoming revenue from what you sell. Double-entry tracks where your money comes from, and where it is going. Essential, you will be recording every transaction twice, picking assets from your credit, and putting somewhere called the debit. Your books are balanced when credit and debit equal each other. Bookkeeping enables you to keep track of your expenses so you can budget better.

QuickBooks Desktop: Limited Compared To Online Version

If your company is larger and more complex, you need to set up a double-entry bookkeeping system. At least one debit is made to one account, and at least one credit is made to another account. If you use cash accounting, you record your transaction when cash changes hands. You also need to understand what debits and credits are before you can start to enter any transactions. Any transaction posted in your ledger or your accounting software will be a debit or a credit. The main goals of bookkeeping are to keep track of transactions and to ensure financial records are kept in order.

- Do you feel lost when reading or hearing financial terminology from your bank, insurance, investment agent, or the IRS?

- With a cash account system, you’ll record transactions anytime cash changes hands.

- Often bank fees, interest payments, deposits, and payments that haven’t yet hit your bank accounts will need to be accounted for.

- The IRS also has pretty stringent recordkeeping requirements for any deductions you claim, so having your books in order can remove a huge layer of stress if you ever get audited.

- However, Xero is a great match for those growing businesses or startups whose accounting needs have outstripped their current system’s capabilities.

Features of QuickBooks Self-Employed include tracking mileage, sorting expenses, organizing receipts, and estimating and filing taxes seamlessly through TurboTax. QuickBooks bookkeeping 101 Online is the best small business accounting software due to its industry popularity and user resources. You must always ensure secure storage of your bookkeeping records.

How do I choose the right accounting software for my business?

Many small business owners focus on company expenses but place expected funds on the backburner. It could affect a business severely because late-paying parties can take advantage of this and not pay you on time. It impacts your ROI and CF and misrepresents your business on the balance sheets. It’s important to leave an audit trail when conducting financial transactions to ensure transparency and accountability.